Browse Your Medicare Choices: Medicare Supplement Plans Near Me

Browse Your Medicare Choices: Medicare Supplement Plans Near Me

Blog Article

Exactly How Medicare Supplement Can Enhance Your Insurance Coverage Coverage Today

As people browse the ins and outs of health care strategies and look for thorough defense, recognizing the subtleties of supplementary insurance coverage comes to be significantly crucial. With an emphasis on linking the spaces left by standard Medicare strategies, these additional choices provide a tailored method to meeting specific demands.

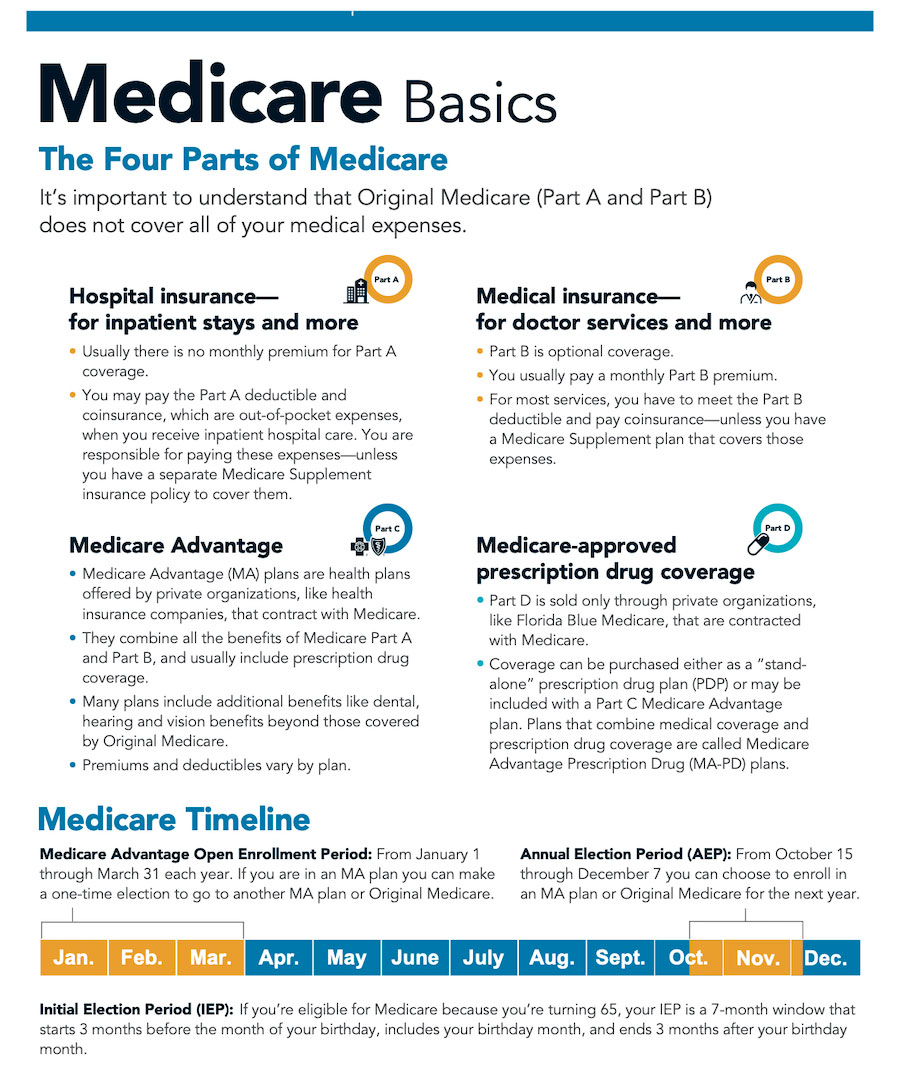

The Fundamentals of Medicare Supplements

Medicare supplements, additionally referred to as Medigap plans, supply added coverage to fill up the voids left by original Medicare. These extra strategies are provided by personal insurance policy firms and are designed to cover costs such as copayments, coinsurance, and deductibles that are not totally covered by Medicare Component A and Part B. It's important to keep in mind that Medigap strategies can not be made use of as standalone plans but job along with original Medicare.

One key aspect of Medicare supplements is that they are standardized across many states, using the very same fundamental benefits regardless of the insurance coverage supplier. There are ten various Medigap strategies classified A with N, each supplying a various level of protection. Plan F is one of the most extensive options, covering almost all out-of-pocket costs, while various other plans may supply more limited insurance coverage at a reduced costs.

Comprehending the fundamentals of Medicare supplements is important for individuals approaching Medicare qualification that want to improve their insurance policy coverage and reduce possible monetary concerns connected with medical care expenditures.

Recognizing Coverage Options

When considering Medicare Supplement intends, it is critical to recognize the various protection choices to ensure comprehensive insurance defense. Medicare Supplement intends, likewise understood as Medigap policies, are standard throughout the majority of states and classified with letters from A to N, each offering varying levels of insurance coverage - Medicare Supplement plans near me. In addition, some plans may supply protection for services not included in Initial Medicare, such as emergency care throughout foreign traveling.

Advantages of Supplemental Program

In addition, supplemental plans use a more comprehensive array of coverage alternatives, consisting of accessibility to healthcare service providers that may not accept Medicare project. One more benefit of supplementary strategies is the capacity to take a trip with tranquility of mind, as some plans provide protection for emergency medical solutions while abroad. Generally, the benefits of additional plans contribute to a more thorough and customized approach to health care protection, guaranteeing that individuals can receive the treatment they require without dealing with overwhelming financial concerns.

Cost Considerations and Financial Savings

Offered the monetary safety and security and broader insurance coverage alternatives given by supplementary plans, an important aspect to take into consideration is the expense considerations and potential financial savings they use. While Medicare Supplement prepares require a month-to-month premium in enhancement to the typical Medicare Part B costs, the advantages of lowered out-of-pocket expenses often exceed the added expenditure. When examining the expense of supplemental strategies, it is important to contrast premiums, deductibles, copayments, and coinsurance throughout different strategy kinds to figure out the most cost-efficient option based upon individual medical care needs.

By choosing a Medicare Supplement strategy that covers a greater percent of medical care expenditures, people can minimize unexpected costs and spending plan more efficiently for medical care. Eventually, investing in a Medicare Supplement strategy can use useful economic directory protection and peace of mind for beneficiaries looking for comprehensive coverage.

Making the Right Selection

With a selection of plans readily available, it is vital to evaluate aspects such as protection alternatives, premiums, out-of-pocket prices, supplier networks, and overall worth. Additionally, examining your budget restraints and comparing premium prices among various strategies can assist make certain that you choose a strategy that is budget-friendly in the long term.

Conclusion

Report this page